It is definitively not easy to keep your composure when markets are in free fall mode. But, during these bad times, there is only one thing to do to keep a portfolio in the best shape:

Focus on top quality companies that are poised to rebound faster than the rest of the market.

Sound obvious, but not that easy?

It can be. With Super Stock Screener, you have access to a time-proven Stock Rating System that does all the job for you. Stocks rated as Strong Buys are your best allies out there. See below how our model portfolios recover much faster than the broad market after the most recent market meltdowns.

Every stock selected in the model portfolio is ranked as a Strong Buy by the time-tested Super Stock Screener Rating System - Only companies with the best fundamentals can be included.

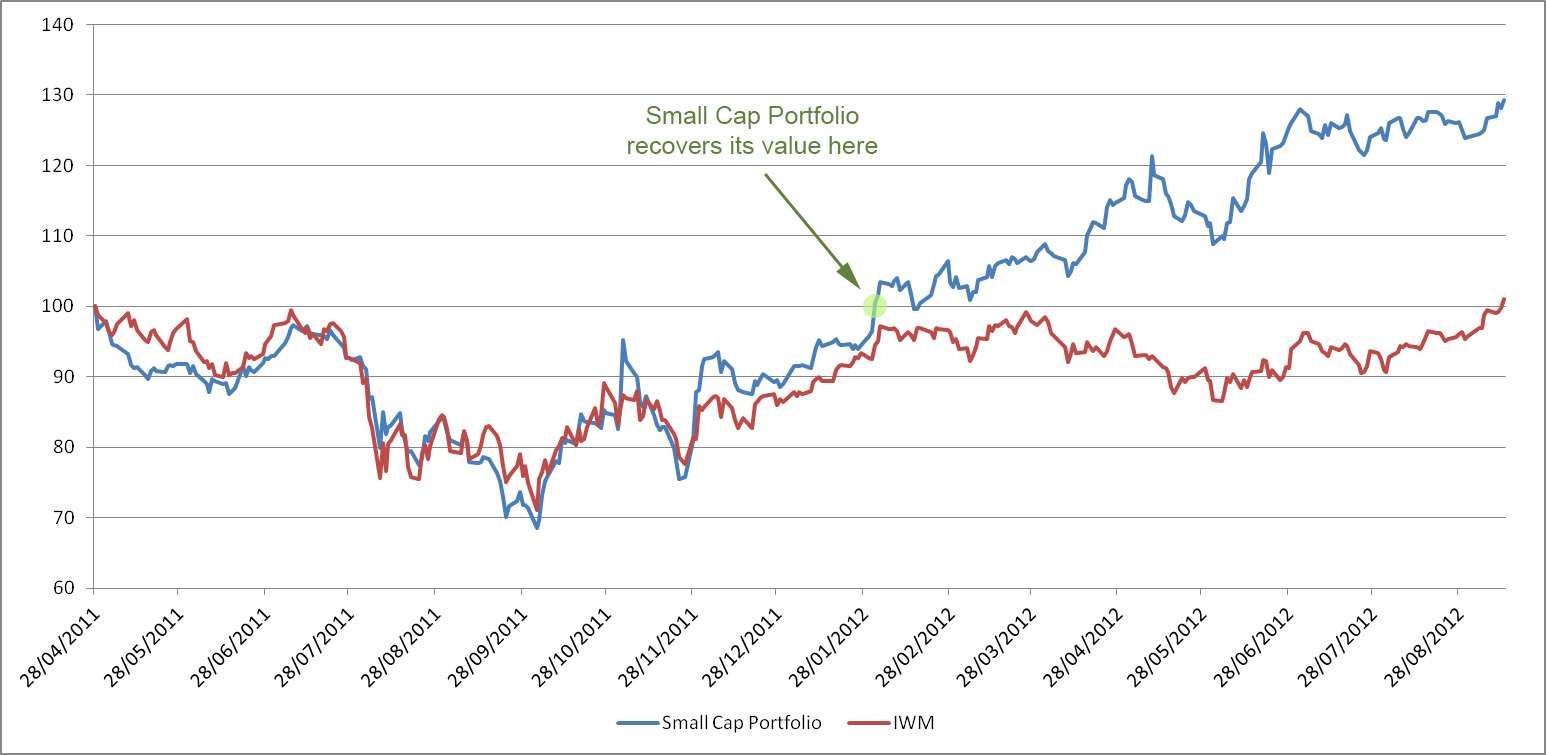

It is a fact, over the long-term markets increase in value but not without bumps in the road. Downturns have to be expected but the most important point is that a well-built portfolio recovers faster than the market after a downturn.

See below how the Small Cap portfolio recovered and beat the market during the bad times of 2008 and 2011:

In 2007-2008, the Small Cap portfolio recouped its losses by May 1st, 2009, while it took 3.5 years for the broad market to recover. When this eventually happened, the Small Cap portfolio had earned you 148% on your investment!

In 2011, the Small Cap portfolio recouped its losses in just 9 months, while it took the broad market 16 months to recover, almost twice as long. At that point, your investment would have grown by an additional 29% with the Small Cap portfolio!

Easy - just sign up for our free trial and you’ll see them immediately. There is no cost for the first 30 days and you can cancel at any time!

Subscribe today, you will benefit from the following:

Buy & sell stock ratings on over 5500 stocks.

Buy & sell stock ratings on over 5500 stocks. Quickly see how your favorite stocks are rated!

Quickly see how your favorite stocks are rated! Sample model portfolios if you prefer to spend as little time as possible picking stocks. A huge time saver!

Sample model portfolios if you prefer to spend as little time as possible picking stocks. A huge time saver! A unique stock screener that includes our stock ratings as part of its screening criteria.

A unique stock screener that includes our stock ratings as part of its screening criteria.Click the button below to get access now.